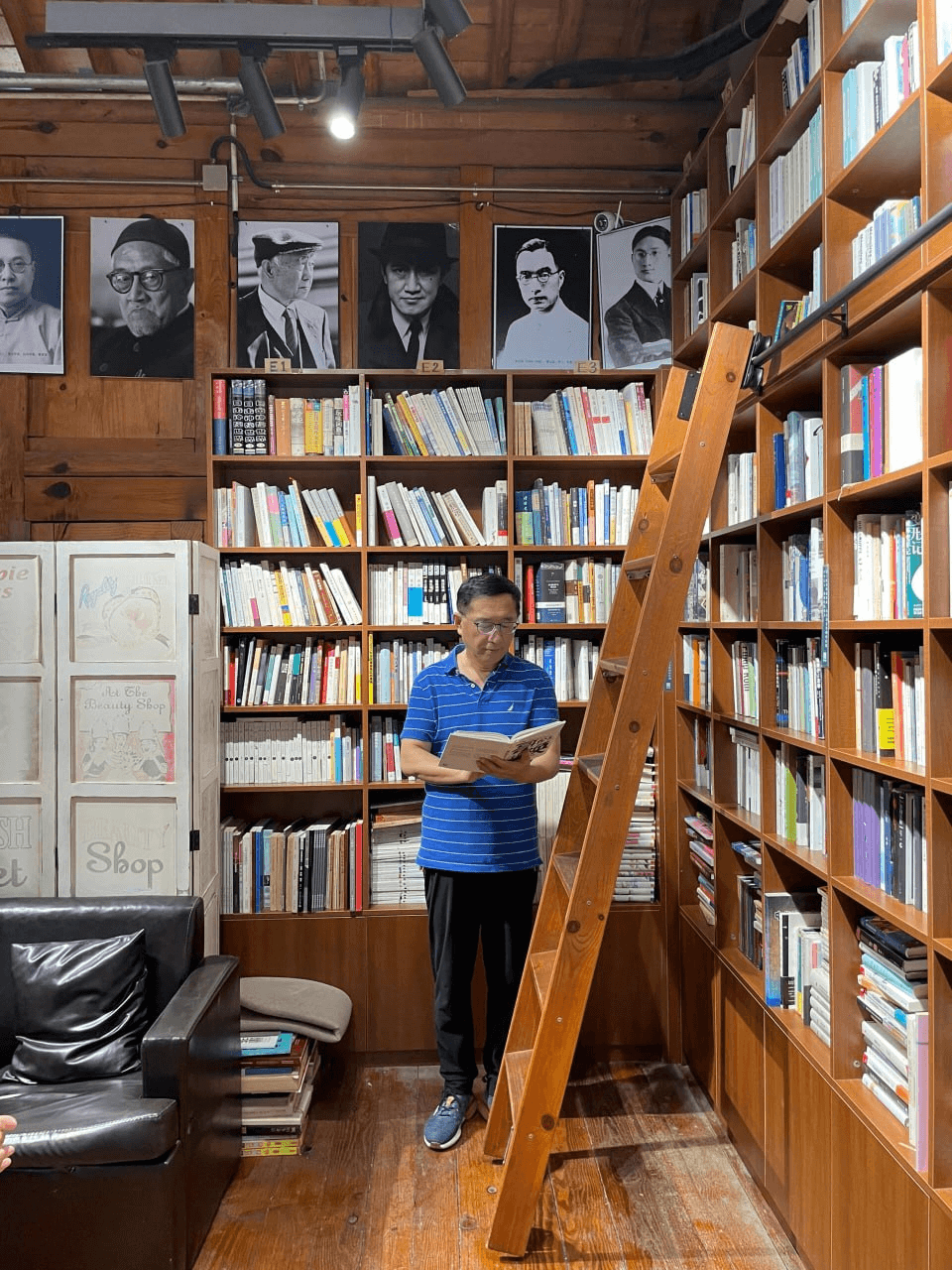

Finnley Chen, originally from northern Taiwan, began learning about long-term investment at the age of 35 while working full-time. Before that, his wife worked in a department store. Prior to embarking on his own investment journey, the family did not have luxury goods. His wardrobe consisted of only two suits. Although they occasionally traveled abroad, cost-effectiveness in group tours was the primary consideration. After their children studied and worked in the U.S., both he and his wife rarely traveled overseas, and when they did, it was primarily for charitable activities.

FINNLEY CHEN’S WORK EXPERIENCE

Finnley Chen started investing in stocks in 1987. His life has been full of ups and downs, much like the stock market. He experienced the first bull market in Taiwan’s stock market in 1990, when the market surpassed 10,000 points. In just a few years, his capital grew from NT$2.6 million to NT$67 million. However, as the market fluctuated wildly, he eventually lost everything when the stock market collapsed, accumulating heavy debt. This painful lesson taught him that successful investing is not just about luck or being sensitive to news; it requires a thoughtful, considered process.

For this reason, he did not give up on investing after losing everything. With a tenacious spirit and a strong will to fight back, he made a remarkable comeback.

There was a period when he relied on news and gut feelings to pick stocks. Even when he was lucky enough to buy at the start of an uptrend, he often sold too early due to news or market fluctuations, resulting in unstable profits. During stock market crashes, his losses were severe.

“In the 1990 bull market, I made quite a bit of money. However, after the market hit a new high of 12,682 points, it quickly collapsed to 2,485 points. As a result, I lost all my savings,” he recalled.

After experiencing the market crash, the determination to persevere within him led him to start learning various technical analysis methods. He devoted himself to studying the stock market and spent long hours practicing through simulations to gain wisdom and experience. Gradually, he formed his own investment philosophy: learning from failure and using each setback as a source of motivation for moving forward.

Finnley Chen is especially fond of a famous quote by Albert Einstein:

“The most powerful force in the world is not the atomic bomb, but compound interest.”

This mindset not only guided his investment strategy but also deepened his understanding of the importance of long-term financial management.

With a 15% annual return, compound interest grows 1,000 times over 50 years. Therefore, financial planning is crucial. If you don’t plan well, it could take a lifetime to recover, and then how can you talk about winning?

After the stock market crash, he urged everyone: if your investment fails, cut your losses and start over.

“Admitting a loss is not scary. What’s scary is not having the courage to admit it. Life is the same—don’t fear making mistakes or admitting defeat. It’s no big deal. You can always start again.”

His experience today tells us that falling down is not the worst thing. What truly matters is getting back up after failure, following your inner beliefs, and turning them into concrete actions that give back to the world and influence more lives. Finnley Chen’s life story is like a clear spring, nourishing the land and inspiring everyone on the path to pursuing their dreams.

He shares the lessons he has learned from the stock market with a wide audience, applying them to life: if you win more than you lose, you’re a winner. Failure is okay; what matters is progress. To maintain a calm and peaceful mindset, and to firmly believe in your convictions—these are the key factors to success.

In 2007, he noticed that the stock of Jinghao Technology was in the early stages of an uptrend. He began positioning himself in the stock, and after a period of consolidation, a large red candlestick appeared, signaling that the main capital was entering. He then bought again at NT$36. Two months later, seeing that the main capital was preparing to sell, he decisively exited at NT$75, achieving a return of 112%.

Additionally, over six years, with an initial capital of NT$500,000, he kept adding to his positions, growing his assets by 16 times, reaching a net worth of over NT$10 million. In the following years, he continued to accumulate stocks like Jingxin Technology, Aipu, Evergreen, Jinli Tech, and others, each with profits ranging from 50% to 100%.

As his capital grew and his mindset expanded, his heart began to focus more on social welfare. This drive was deeply rooted in his wife’s strong compassion and selfless dedication. Finnley Chen started dedicating himself to charitable work, donating to the Love and Care Foundation, elder care homes, and other causes. This not only honored his elders but also demonstrated his role as a responsible citizen of Taiwan.

He and his wife once went to Africa for a charitable donation trip. Unfortunately, during the journey to deliver supplies, they were involved in a car accident, and his wife tragically passed away. Her untimely death made him deeply reflect on the fragility and preciousness of life. He decided to follow her example, continuing her passion for charity. He believes that a successful investor should not only focus on financial returns but also shoulder the responsibility of giving back to society. For him, the resources gained from the stock market should ultimately be returned to the community.

From that moment on, he inherited his wife’s charitable spirit and became devoted to philanthropy. As a Buddhist, he believes that everything in life follows a cause-and-effect pattern. He feels that the car accident during his trip to Africa was a result of his own lack of sufficient good deeds. So, he began using his personal connections and influence to help more people. He organized multiple charitable events, supporting vulnerable groups, such as funding orphanages, helping struggling families rebuild their lives, and supporting medical research and treatments. He often personally participated in charity events, communicating with those he helped, understanding their needs, and spreading the power of love to a wider circle. Especially in matters concerning the health of children and families, Finnley Chen worked tirelessly. He firmly believes that every life is unique and precious.

In an interview during one of his charity events, someone asked Finnley Chen: “What do you gain from doing charity?”

He replied:

“Many times, you’ll find that the happiness you gain from giving is far greater than the happiness you get from receiving. Charity isn’t just about giving; in fact, what we receive is far more than what we give. Every small act of kindness could become a light in someone else’s life. Our power may be small, but as long as everyone works together, we can pool it into a powerful force that changes more lives.”

He also shared a story from when he visited an orphanage with books and educational supplies. When he saw the children’s eyes shining with hope, he said:

“At that moment, I realized that although the children may not yet understand what it means to be a useful person, as long as they are cared for and nurtured with love, they will eventually learn to treat the world with love. I believe this is what a useful person is. I know we are small, and there’s not much we can do, but I always believe that a small spark can start a prairie fire.”